1099 Form Onlyfans 2026 Media Video/Photo Direct

Start Today 1099 form onlyfans high-quality digital media. No hidden costs on our digital collection. Become absorbed in in a enormous collection of featured videos unveiled in excellent clarity, excellent for exclusive viewing junkies. With up-to-date media, you’ll always be ahead of the curve. Experience 1099 form onlyfans arranged streaming in crystal-clear visuals for a truly engrossing experience. Enter our media world today to enjoy content you won't find anywhere else with no payment needed, without a subscription. Enjoy regular updates and investigate a universe of specialized creator content perfect for top-tier media lovers. Grab your chance to see singular films—start your fast download! Treat yourself to the best of 1099 form onlyfans specialized creator content with stunning clarity and preferred content.

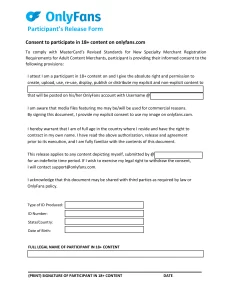

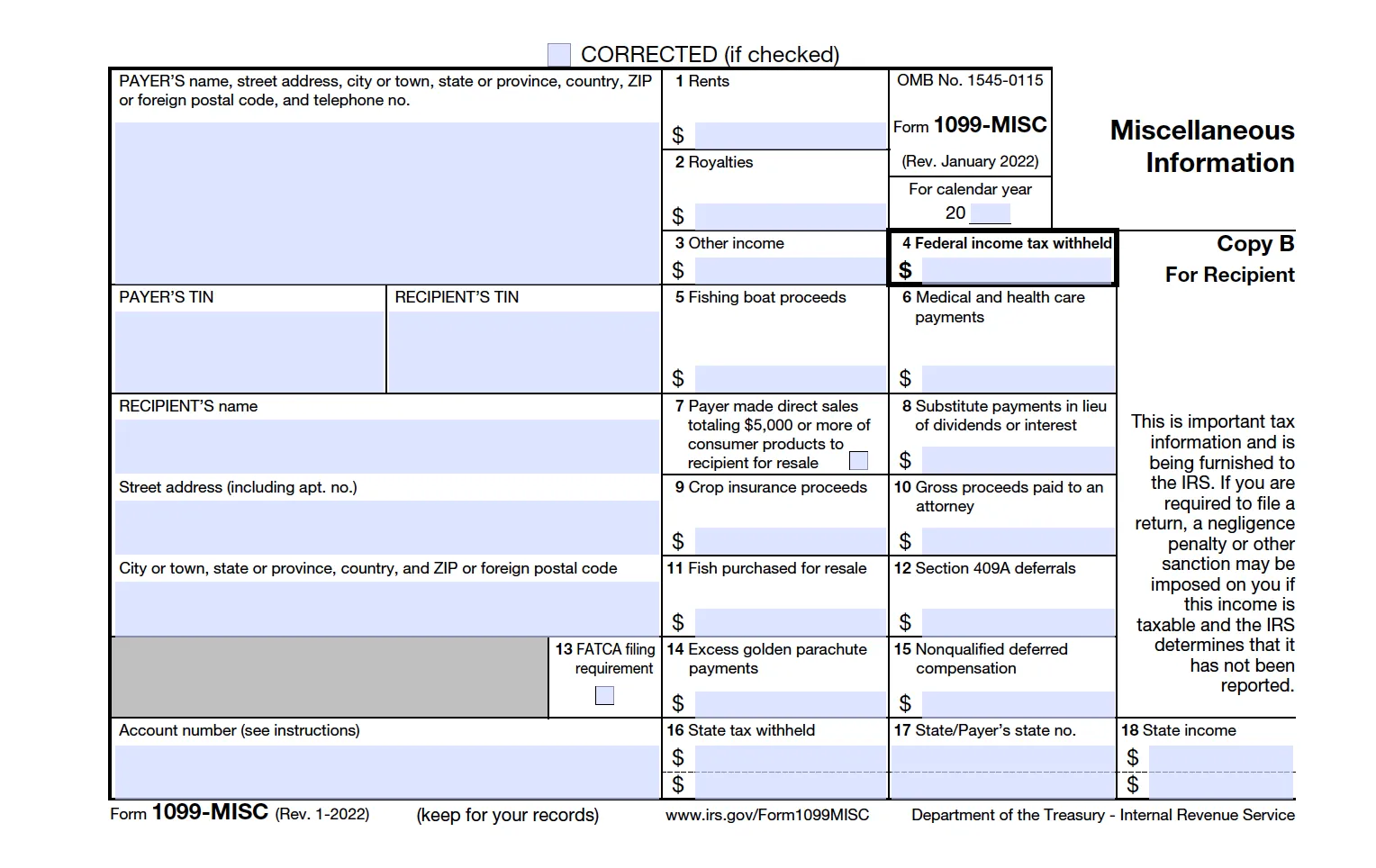

Learn how to get your 1099 form from onlyfans and file taxes as a content creator This document, which is essential for filing your profits with the irs, lists your gross business income from onlyfans. When to expect your 1099

OnlyFans Taxes: How to Pay and Ways to Save

A guide for onlyfans creators navigating tax season Onlyfans taxes giving you a hard time Confused about your onlyfans 1099

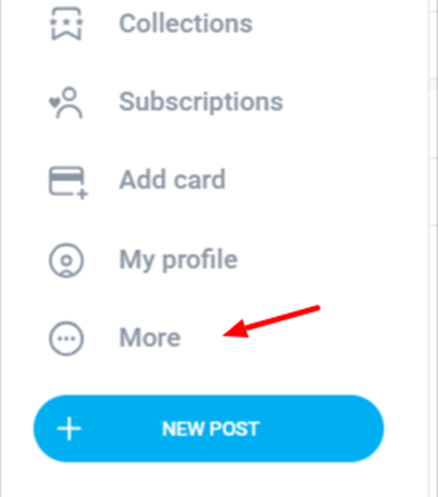

Learn exactly when it arrives, how to download it, and avoid tax filing blunders

Creators, this is for you! Ebay, airbnb, paypal, stripe, etc Learn how to report onlyfans income correctly But how to file a 1099 nec correctly

This form is used to report nonemployee compensation, meaning payments made to independent contractors. Even if you don't receive a 1099 from onlyfans, you are still required to report your earnings to the irs How to get your onlyfans 1099 onlyfans provides 1099 forms electronically through its payment processor.

![OnlyFans Taxes: What Taxes Do I File? [2023 US Guide]](https://www.freecashflow.io/wp-content/uploads/2021/11/W-9-300x183.png)